Financial Stability Starts Here

Holistic financial strategies tailored to your goals.

Build Your Ideal Retirement

At SFA Wealth Management, we believe everyone should be able to live the retirement they’ve always wanted. Your financial situation is different than that of your parents, your neighbors, and even your close friends, so a cookie-cutter approach isn’t going to cut it. We can work with you to create a retirement strategy that fits your unique retirement needs — a strategy designed to get you to your goals.

At your first meeting, we’ll cover these five topics:

Income Planning

Our goal is to help ensure your expenses are paid with reliability and predictability for the rest of your life.

Investment Planning

Tax Planning

We’ll look at the taxable nature of your current assets and potential ways to include tax-deferred and tax-free money in your financial plan.

Social Security Maximization / Health Care Planning

We’ll look at Medicare, Parts A, B, and D, and long-term care options in order to address rising healthcare costs. We will also maximize what is oftentimes your largest asset, social security.

Legacy / Estate Planning

Together with qualified professionals, we’ll create a plan that is designed so your hard-earned assets go to your beneficiaries in the most tax-efficient manner.

Your Financial Toolbox

Knowledge is power. It is also the foundation for intelligent, well-considered decisions. When you have retirement in sight, sound decisions are vital in helping you pursue your goals and avoid costly mistakes.

At SFA Wealth Management, we have you covered with your own financial toolbox.

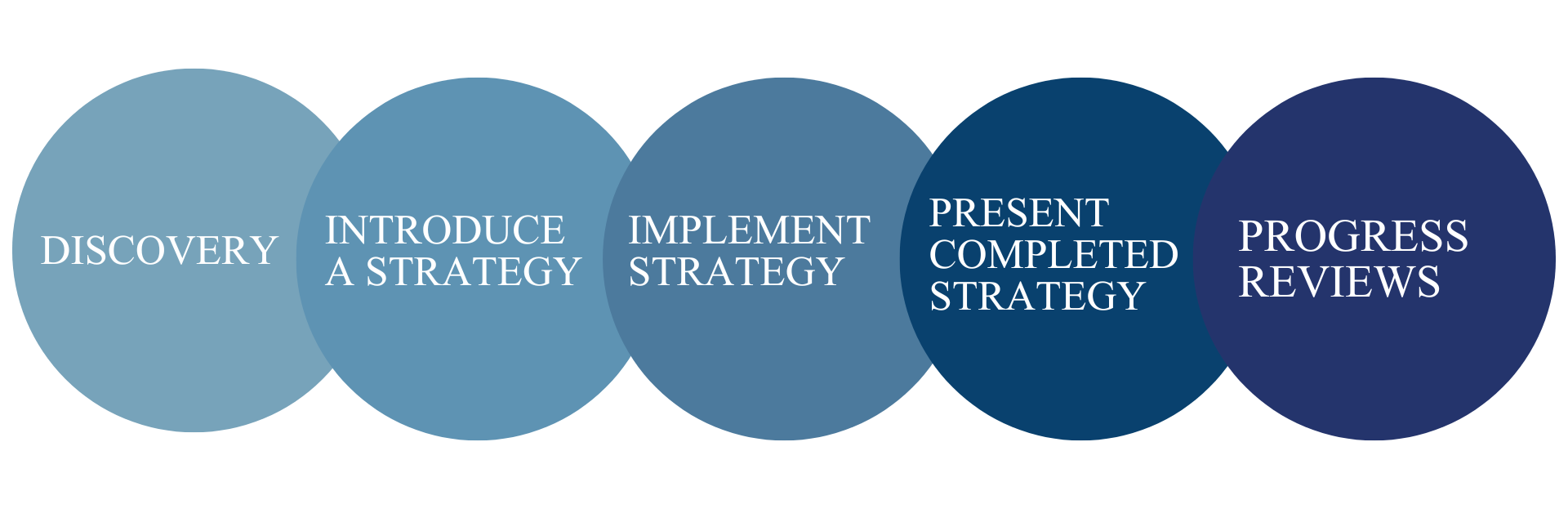

Client Engagement Process

Hover over the title in each circle below to learn more.

Discovery

- Discuss current plan and lifestyle goals.

- Identify risk tolerance.

- Review the "Fiscal House" and how we manage wealth.

Introduce a Strategy

- Review "SFA's Retirement Blueprint."

- Decide if a fit exists, schedule next meeting.

Implement Strategy

- Review plan and address questions.

- Investment/income plan initiated with signature.

Present Completed Strategy

- Provide online login info.

- Provide copy of all files organized.

Progress Reviews

- Review accounts on a regular basis. May be more often than annual, based on strategy.

Let’s Talk Retirement

You’ve dreamed about it and fantasized about the days when your time can indeed be your own. But now, as retirement is coming faster with each workday’s close, are you ready?

Contact Us Today!

Check the background of your financial professional on FINRA's BrokerCheck.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security.

We take protecting your data and privacy very seriously. As of January 1, 2020, the California Consumer Privacy Act (CCPA) suggests the following link as an extra measure to safeguard your data: Do not sell my personal information.

Investment Advisory Services offered through Brookstone Capital Management, LLC (BCM), a Registered Investment Advisor. SFA and BCM are independent of each other. Insurance products and services are not offered through BCM but are offered and sold through individually licensed and appointed agents.

The content of this website is provided for informational purposes only and is not a solicitation or recommendation of any investment strategy. Investments and/or investment strategies involve risk including the possible loss of principal. There is no assurance that any investment strategy will achieve its objectives.

SFA Wealth Management & Senior Financial Advisors is not affiliated with or endorsed by the Social Security Administration or any other government agency.

Fiduciary duty extends solely to investment advisory advice and does not extend to other activities such as insurance or broker dealer services. Advisory clients are charged a monthly fee for assets under management while insurance products pay a commission, which may result in a conflict of interest regarding compensation.

Index or fixed annuities are not designed for short term investments and may be subject to caps, restrictions, fees and surrender charges as described in the annuity contract. Guarantees are backed by the financial strength and claims paying ability of the issuer.

Copyright SFA Wealth Management.